Your rights around inheriting debt in Canada can vary depending on several factors, including provincial…

Do You Need Debt Insurance?

What is debt insurance? Debt insurance is never called debt insurance, it’s called mortgage insurance, balance protection insurance, and other names. Essentially this insurance is to pay back your creditors in the event of your death or life-threatening injury or illness, depending on the specific coverage. Debt insurance has more benefit for your creditors than it does for you, and here’s why: it’s expensive, the monthly premiums do not go down although the coverage does as the debt decreases over time, and it pays only that creditor for that specific debt. Of course it benefits you too if that is your only insurance option, but it isn’t.

Your better insurance option is life insurance. If you have debt, you should have life insurance, not debt insurance. Life insurance and critical illness/injury insurance place you or the person of your choice as the beneficiary, rather than the creditor. Be sure to designate a beneficiary, if you forget your estate will be the beneficiary and your creditors will be able to get at the money that way. Life/illness insurance has a set amount of coverage that does not decrease over time. Life and illness insurance is cheaper, and the money can be used in a way that you choose – pay off one debt or another, or keep the debt and cover costs of living, etc. As well, if you die your debts will be paid out of your estate and any remaining debt not covered will be written off, it is not the responsibility of your family or anyone that is not a cosigner. Meanwhile your life insurance will be paid directly to your beneficiary to support them or to spend how they see fit not to pay debt.

Let’s compare the difference between mortgage insurance and life insurance over the life of a mortgage. In our example we’ll use a mortgage of $500,000 amortizing over 20 years (about $3100 monthly payments with 4.39% interest rate). The mortgage belongs to a male/female couple, both 36 years old, in good health, non-smokers.

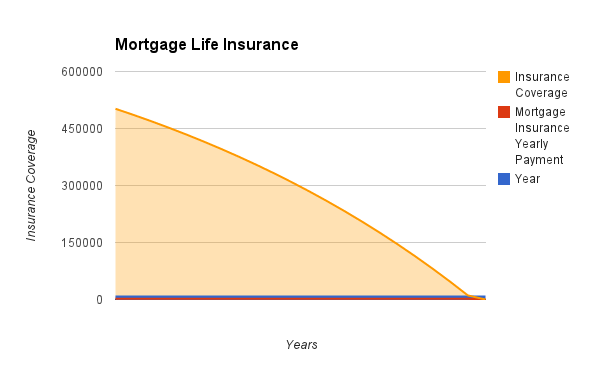

Option A: Mortgage Insurance

Mortgage life insurance for this couple costs $157.50 per month. The mortgage insurance coverage starts at $500,000 at the beginning and decreases every time they make payments on their mortgage. In year one, it costs them $1890 for the year and they are covered for $500,000 (at the beginning). In year 20, it still costs them $1890 for the year and they are covered for only $8,779.27 (the amount remaining on the mortgage). If one dies, the insurance pays out $8,779.27 and if they both die the insurance still pays out $8,779.27.

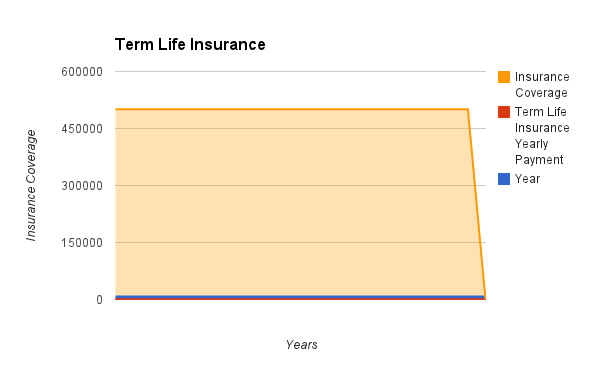

Option B: Term Life Insurance

Term 20 Life Insurance for $500,000 each for this couple costs $62 per month. In year one, they pay $744 in insurance and are covered for $500,000 each. In year 20, they still pay $744 and are still covered for $500,000 each, although their mortgage is now only $8,779.27. If they were to both die, their beneficiaries would receive $1 million total.

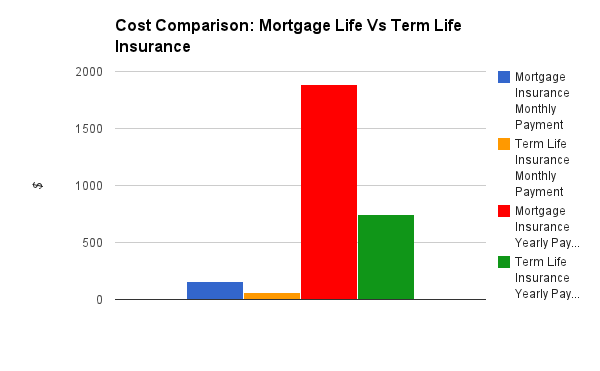

So we can see that the coverage of mortgage life insurance is significantly less than the coverage of term life insurance. We also see that mortgage insurance is far more expensive. Mortgage insurance costs this couple $157.50 per month, term life insurance would be $62. $1890 per year versus $744 per year. Over the life of their mortgage (20 years) they would save $22,920 with term life while being insured for $1M total, rather than $500K – 0.

Now, I’m not an insurance agent, I’m not trying to sell you term life insurance or any other insurance. But I have seen people buried in high interest rates which prevent them from ever being able to pay off their debt, and debt insurance is another high cost hindering people from getting out of debt. That is why I urge you to look into your insurance options, and please don’t be pressured into paying for debt insurance (mortgage insurance, balance protection insurance, etc) because it is not required in order to get the loan and you can decline it. Insurance is a good thing, and you want to protect your loved ones and your estate in the event of your death or illness, so make sure you have the best coverage for you – the appropriate amount, a good insurance provider, and a great price.